On September 3, 2025, the Union Finance Minister and the Tax Advisory Council. The historic 56th GST Council meeting was held at Sushma Swaraj Bhawan in New Delhi. Taxation decisions were made: they shall be made appropriately, transparently, and accessibly.

Simplification of GST Tax Slabs

The slabs were 5%, 12%, 18%, and 28%, and the meeting differentiated and retained only 5% and 18%. The 12% and 28% slabs were abolished.

However, non-singoods (tobacco, pan masala, or luxury cars, etc.) shall be kept in the 40% slab in the same process.

Important Rates for Improvements and Discounts

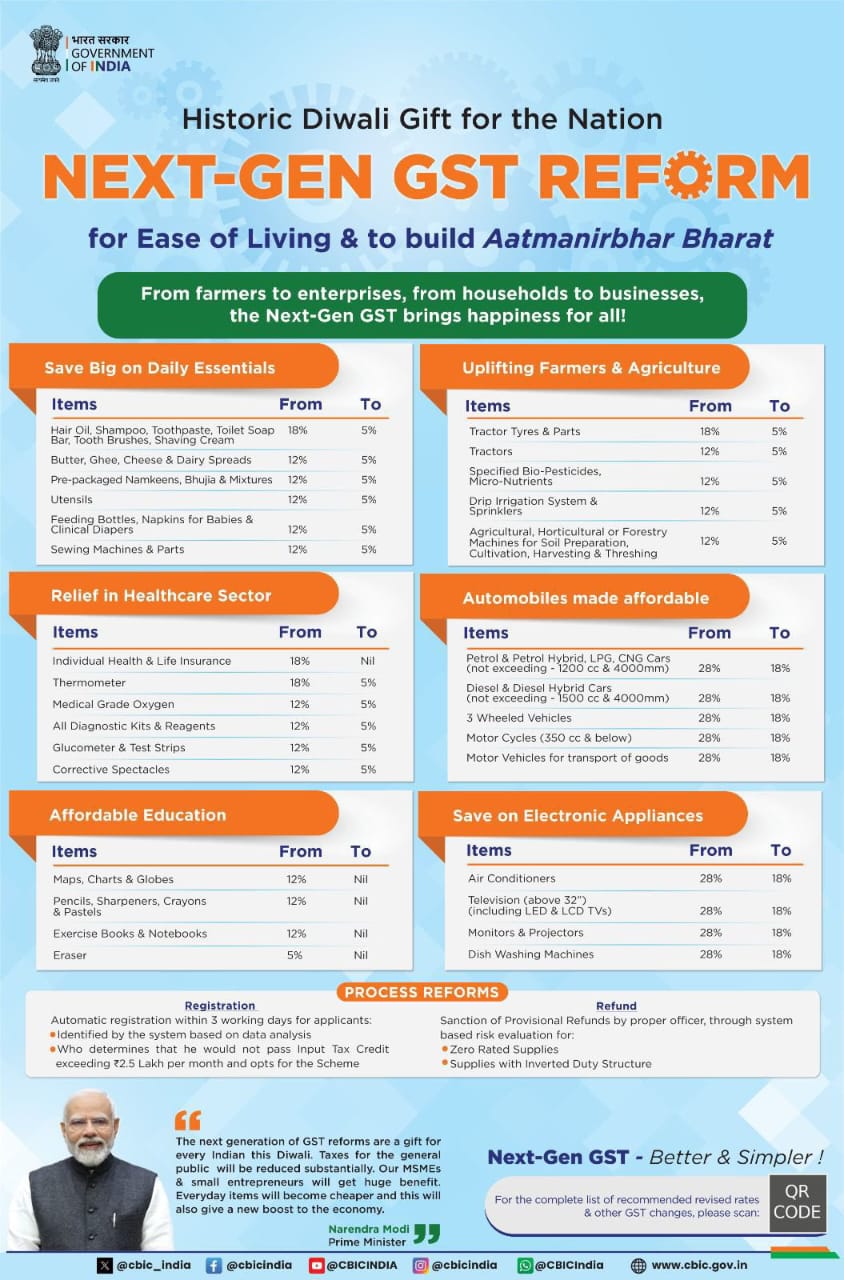

Goods were identified on which GST was slashed to benefit the consumers of the country, and common products:

UHT milk, paneer, roti, paratha, condensed milk, butter, sauce, chocolate, soap, toothpaste, and hair care (shampoo and oil), among others. The taxation levied on such goods will thenceforth be at 5% or a completely zero rate.

Certain medicines (3 essential and 33 life-saving) will have nil.

Tax was brought down from 28% to 18% for white goods and luxury smart TVs (32"+), air conditioners, dishwashers, and other electronics.

Now, small cars: petrol/LPG/CNG up to 1200 cc, diesel up to 1500 cc (now at 18%); large cars and MV/SUVs pay a special 40% tax.

The Tax on hotel rooms of a value of less than or equal to ₹7500/- was lowered from 12% to 5% (excluding ITC).

Being taken down from the previous 18% GST, health and life insurance are now fully nil, widely accessible to the common man.

Institutional and Procedural Reforms

GST Appellate Tribunal (GSTAT) to be formed; September 2025 Appeal will be entertained at the end, nd and hearings will begin by December 2025

Of the orovisional refund of refunds held due to the inverted duty structure, will be given.

Clarification given in the definition of "Specified premises"- there stands the possibility of business disallowance in claiming ITC on stand-alone restaurants using the 18%+ ITC option.

Implementation Period and Stability

All changes will commence from 22 September 2025 (or later in the case of sin goods). These new Tax reforms shall transform the lives of savings of the common man and the middle class, constitute simplified tax structures, reduce business hassles, and ensure legal certainty and a smooth flow of tax administration.n The decisions of the Meeting will be implemented from 22nd September 2025 and will give a new impetus to the economy.

You can also read:

Best Smart TV Under Rs. 25,000 in 2025 – Unbelievable Features at a Jaw-Dropping Price!

Follow our WhatsApp channel for the latest news and updates